The Internationalisation of Midland Bank: Edward Holden and Correspondent Banking Relations in the United States and Canada (1891-1919)

Asif is a final-year undergraduate student pursuing a degree in History at Somerville College, University of Oxford. Asif’s primary academic interest revolve around economic history, more specifically understanding the roles of institutions and other factors in shaping the economic development of countries. This project provided him an opportunity to explore the roles of international banking and its subsequent development. UNIQ+ programme also provided him with an on-hand experience of academic research and profoundly helped him acquire the necessary and invaluable quantitative and qualitative skills. He is now in the process of applying for master with focus on Economic and Social History.

This research project seeks to identify and analyse the expansion of the international network of correspondent banking relationships of the Midland Bank between 1891 and 1919. The project draws on archival evidence and other contemporary sources to highlight the significant role of Edward Holden in the development of Midland’s correspondent banking.

Edward H. Holden and Midland Bank

Edward Hopkinson Holden had a formidable record in building Midland Bank’s business and constructing its international correspondent banking network. Born in Lancashire in 1848, Holden had a humble upbringing and began a banking career at nineteen as a junior clerk in the Manchester and County Bank for a salary of £30 a year. He stayed with this bank for fourteen years but, due to limited opportunity and absence of recognition, he was driven to consider an accountant position in the Birmingham and Midland Bank that The Economist advertised in early 1881.

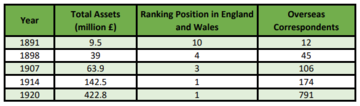

Table 1. Midland Bank: Total Assets, Ranking Position, Overseas Correspondents, 1891-1920 Sources: Total assets and number of correspondents taken from London City & Midland Bank, Annual Report and Accounts, several years, HSBC Group Archives (hereon HSBCGA). Ranking position taken from Green, Calling London, 3; Holmes and Green, Midland, 97, 129, 150; and Wardley, “Commercial Banking Industry,” 75-77.

Holden immediately found his passion within this bank. In return, the bank ensured that his contributions were recognised and rewarded. His rise in Midland Bank was meteoric. After two years of joining the bank, he was appointed secretary; after four years, in 1887, he became sub-manager; in 1891, he became joint manager. In 1897, he became sole general manager, shaping Midland Bank’s trajectory. He remained in that position until he was promoted to chairman and managing director of the bank in 1908, the highest position in Midland, until he died in 1919.

Midland Bank’s Growth, 1891-1920

Throughout the 1890s, the Midland Bank had impressive growth at home through mergers and acquisitions with other county banks and, in the process, expanded to the heart of the City of London, in Threadneedle Street. In 1902, the bank focused on overseas business considerably by establishing the Foreign Banks Department. A growing commitment to international operations and greater diversification led to Midland Bank’s rapid growth, eventually becoming the largest bank in the world by assets. Table 1 summarises the impressive growth of Midland Bank in terms of assets, its ranking position in England and Wales, and the number of overseas correspondents the bank had established.

Midland Bank’s Correspondent Banks, 1891-1920

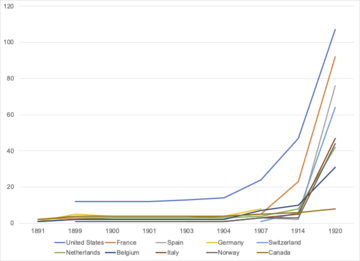

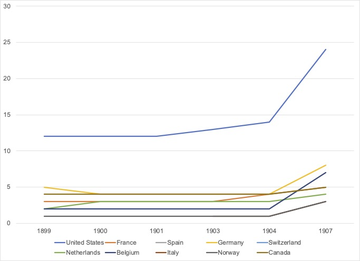

Graph 1. Midland Bank: Correspondent Banks in Top 10 Countries, 1891-1920 Sources: London City & Midland Bank, Annual Report and Accounts, several years, HSBCGA.

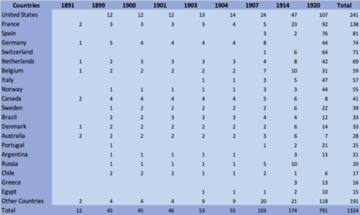

Table 2. Midland Bank: Correspondents by Country, 1891-1920 Sources: London City & Midland Bank, Annual Report and Accounts, several years, HSBCGA.

Using records from the HSBC Archive, I assembled a dataset accounting for Midland Bank’s correspondents (see Graph 1 and Table 2). In 1891, Midland Bank had 12 correspondent banks in 9 countries and 9 cities. By 1920, Midland had 791 correspondent banks in over 60 countries and 300 cities, giving it a footprint in every major financial centre worldwide. Correspondent banks allowed Midland to act as a bankers’ bank in London; in return, these banks handled Midland’s business in their regions. As the number of correspondents increased worldwide, so did the bank’s total assets (see Table 1). In 1891, Midland Bank ranked tenth position in England and Wales with a total assets of £9.5 million. It consolidated its domestic expansion by 1898, when it acquired City Bank limited in London and inherited its overseas correspondents, taking the total to 45. Then, Midland became one of the four largest banks in the United Kingdom with total assets of £39 million.

How and Why Correspondent Banking Relations Emerge: A Case Study

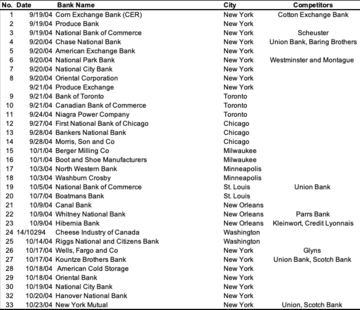

Table 3. Edward Holden’s Trip to North America, September-October 1904 Source: "Mr Holden’s Report on His Visit to America,” September 10-November 5, 1904, ref. UK0150-0002, location 8.B.1 (hereon “Report”), HSBCGA

Graph 2. Midland Bank: Correspondent Banks in Top 10 Countries, 1899-1907 Sources: London City & Midland Bank, Annual Report and Accounts, several years, HSBCGA.

Holden’s forceful personality set Midland Bank into a sustained expansion. His keen curiosity and appetite for information made him a leader in British banking. He was driven and absorbed by the bank’s business. Holden’s fascination with and commitment to international banking and overseas business was demonstrated by his visit to North America in late 1904, a trip of two months that required a persuasive business case and the bank’s board of directors’ approval. He travelled to North America to learn more about Midland’s existing partners and to establish new correspondents, especially where it had no representatives, such as in New York, where Holden spent 32 of 56 days of the trip (see Graph 2 and Table 3).

Holden visited nine cities in the United States and Canada, covering approximately 3,600 miles by railroad in the autumn of 1904 (see Map 1). Holden’s 120-page travel diary (20,000 words) provides a first-hand description of the society and economy of the cities he visited and covers their banking and industrial sectors in lengthy detail.

Map 1. Edward Holden’s Trip to North America, September-October 1904 Source: Holden, “Report,” HSBCGA.

The report demonstrates Holden’s willingness to learn about the operation of banks, industrial performance, and production techniques, often noting what he would like to adopt and implement back home to improve efficiency. For example, Holden emphasised telephones and tape machines, widely used in U.S. banks. Holden was also fascinated with banking employees’ qualifications, training, and specialisation, which led to the introduction of voluntary courses in Midland Bank.

The first diary entry occurred in New York City on Saturday, 17 September. On Monday, Holden visited the New York Clearing House, the New York Stock Exchange and opened an account at the Corn Exchange Bank. While in New York, Holden conducted business deals with nine banks.

On 21 September, Holden left for Toronto, Canada. The Bank of Toronto arranged a trip for Holden to visit Niagara Falls. Holden also came back with detailed information on the Niagara Power Company. Holden was amazed by the Canadian education system and the teaching of international banking, which he thought British universities should adopt.

Chicago was the next stop on Holden’s itinerary. He arrived there on 27 September and left for Milwaukee on 1 October. In Chicago, Holden struck business with three banks. However, most importantly, Holden met informally over lunch and dinner with some influential bankers, including Charles G. Dawes (better known for the post-WWI Dawes Plan). Holden visited the meatpacking firm Nelson Morris and Co., which persuaded him that Chicago was the U.S. Midwest city where Midland needed a prominent presence.

Cotton production was still a significant economic sector in the U.S. Southern states. Cotton growers relied on commission agents or factors to finance and sell their cotton. The factors charged cotton growers 10% and borrowed at 5-6% from banks. Cotton growers soon became aware of this margin and sought to diminish their dependence on agents. Holden saw an opportunity for Midland by directly providing credit to cotton growers. Midland Bank had a substantial participation in cotton financing in Great Britain. Holden sought to forge correspondent relationships with New Orleans banks to circumvent New York banks. Midland could trust these banks, but they entailed costs of 75 cents for sending $1,000 in funds to New York and later to U.S. cotton growers.

Holden expected New Orleans to be in a position to "receive a great impetus" in trade from the city’s proximity to the Panama Canal, then under construction. In New Orleans, Holden established deals with the Canal Bank, Whitney National Bank, and Hibernia Bank, providing Midland Bank a presence in the U.S. South. Forming new correspondent relationships with banks in Chicago and New Orleans expanded Midland’s customer base into booming industrial cities in the U.S. Midwest and the U.S. South and broke its dependence on New York banks.

Concluding Remarks

This research project highlighted the role of Edward Holden in the rise and internationalisation of Midland Bank in the late nineteenth and early twentieth centuries. In the British market, Holden solidified Midland’s position as one of the “big five” banks through strategic acquisitions and takeovers of other banks. He then shifted focus to the international market by utilising correspondent banking. Holden’s strategies were to “influence the position and character of the bank for the generations to come”, as historian Edwin Green has emphasised.

References

Primary Sources

HSBC Group Archives, London

Birmingham & Midland Bank, Annual Report and Accounts of the Birmingham and Midland Bank, several years, 1891-1898

Edward H. Holden, "Mr Holden’s Report on His Visit to America,” September 10-November 5, 1904, ref. UK0150-0002, location 8.B.1

London City & Midland Bank, Annual Report and Accounts of the London City and Midland Bank, several years

London City & Midland Bank, Report of Proceedings of General Meeting of Shareholders, 1899-1901, 1903, 1904

Bibliography

W. Frank Crick and J. Edwin Wadsworth, A Hundred Years of Joint Stock Banking. London: Hodder & Stough, 1958.

Edwin Green, Calling London: Travels by British Bankers, 1904-63. London: Threadgold Press, 2017.

A.R. Holmes and Edwin Green, Midland: 150 Years of Banking Business. London: Batsford Ltd., 1986.

Peter Wardley, “The Commercial Banking Industry and its Part in the Emergence and Consolidation of the Corporate Economy in Britain before 1940,” Journal of Industrial History 3 (2), 2000, 71-97.